draftkings 1099 misc|DraftKings : Baguio If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you . You may sign up at Slots Capital Casino and get a $50 bonus without making a deposit. To receive the offer, enter the promo code for the $50 Free Bitcoin Bonus upon registering. You can withdraw $180 after meeting the bonus' 60x wagering requirement.

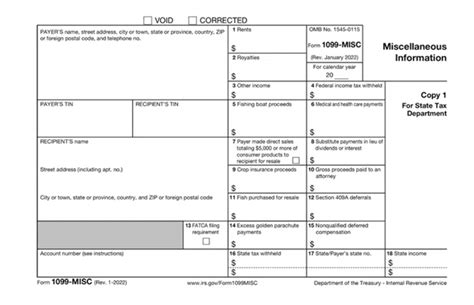

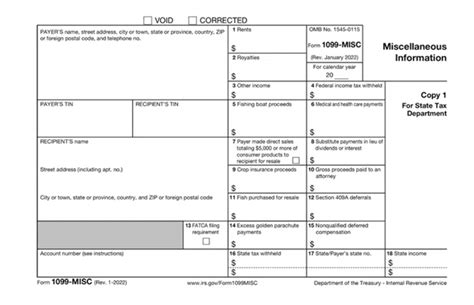

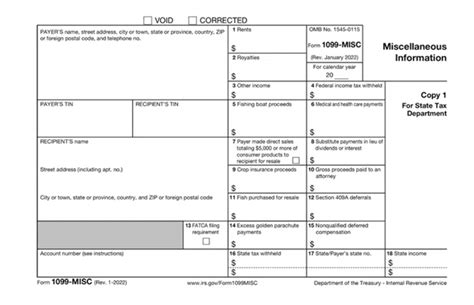

draftkings 1099 misc,If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings from the prior .draftkings 1099 miscIf you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you .Forms 1099-MISC and Forms W-2G are expected to be available online at the .If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to receive your tax forms no .Forms 1099-MISC and Forms W-2G are expected to be available online at the end of January 2024. A separate communication will be sent to players receiving tax forms as they are . You’ll likely get a 1099-MISC, which reports miscellaneous income. However, if you received your payouts from third-party payment platforms like Stripe or PayPal , you may receive a 1099-K — which reports payments . If you strike lucky and you take home a net profit of $600 or more for the year playing in sportsbooks such as DraftKings, the operators have a legal duty to send both yourself and the IRS a Form 1099-MISC.Fantasy sports organizers must send both you and the IRS a Form 1099-MISC or 1099-K if you take home a net profit of $600 or more for the year. Fantasy sports organizers use a formula to determine when a player hits the $600 level. You can enter the amount from your 1099-MISC in the gambling winnings section. It will first ask you if you received a W-2G for your winnings. After you answer No, it will ask .

The best place to play daily fantasy sports for cash prizes. Make your first deposit! The best place to put this 1099 is under ''Other Common Income''. It can be found in the Wages & Income section, and I have attached a screenshot. After you enter the 1099 .

If during the year your winnings exceed $600, DraftKings will send you a Form 1099-MISC. As it’s your responsibility to report all income, even earnings under $600 should be declared. However, tax withholding, or the .

This form is similar to the 1099 form and serves as a record of your gambling winnings and as a heads-up to the IRS that you’ve hit the jackpot. You then must report all gambling winnings on your tax return. Even if you .In practice, at least for DFS, DraftKings will send you a 1099-MISC with the amount as your net winnings, but ONLY IF your net winnings are at least $600. Here "net winnings" includes all bonuses etc.. Basically it is (balance on 2023 .To ensure that DraftKings has the correct information for your tax forms, please visit the DraftKings Tax ID form to confirm or update your details.. Note: Fantasy app customers can update their IRS Form W-9 via desktop, laptop, or mobile web.

For Draftkings Reignmakers "winnings" they send you a 1099 Misc. Entering that # in TurboTax in the "other" income section (where it belongs) doesn't give you an option to select gambling losses to offset the "winnings". There has to be a way to deduct the cost of the contests, otherwise I lost mo.The information provided on this page doesn’t constitute tax advice and DraftKings advises its customers to consult with a professional when preparing their taxes. Learn more about the IRS's taxable reporting criteria for gambling winnings and IRS Form W .DraftKings Agree. Speak with tax professional. I never received 1099 from DK or FD on my earnings (not over $600 individually), but I withdrew over $600 over the course of the year, net earnings from both, and received a 1099 from PayPal. If during the year your winnings exceed $600, DraftKings will send you a Form 1099-MISC. As it’s your responsibility to report all income, even earnings under $600 should be declared. However, tax withholding, or the amount directly deducted by DraftKings from your winnings, is only applicable in specific cases. . I received a 1099-Misc of $5,661 from FanDuel and have filed that on my tax return. On Draftkings, I had a yearly loss of $1,300. Can I offset these fantasy sports sites? Announcements. Attend our Ask the Experts event about Self-Employed Quarterly Filing on Aug 28! >> RSVP NOW! If you’re a winner and your net profit exceeds $600 in a calendar year, DraftKings will issue you a Form 1099-MISC. This is a standard IRS form used to report miscellaneous income, like non-employee compensation and rewards. Remember, whether or not you receive Form 1099-MISC, all your DraftKings winnings are taxable. Even if you don't receive a 1099 form, you are still required to report all of your income on your federal and state income tax returns. The IRS planned to implement changes to the 1099-K . The 1099-Misc form has a due date of January 31 (for the previous calendar year) for the issuers and players can expect to receive these by then or shortly thereafter. It would be a good idea when receiving the 1099-Misc that the information contained in the form is reviewed for accuracy like SSN, name, address, and especially the income amount .Receive a 1099-MISC from FanDuel or DraftKings? Got questions about Fantasy Sports, Sports Betting, Gambling and Cryptocurrency Taxes? Then you came to the right place! We’re focused on providing unparalleled, valued added tax and consulting services to the casual and professional Fantasy Sports Player, Sports Bettor, Gambler and . If you have winnings of over $600 from any Daily Fantasy Sports site, such as FanDuel or DraftKings, you will likely receive a Form 1099-MISC with the amount shown on Box 3. . Box 3 of the Form 1099-MISC, as opposed to Box 7- Nonemployee Compensation, would suggest that the DFS winnings are a Prize. However, .Tax information, forms, and key dates. Our team is available 24 hours a day, 7 days a week.DraftKings Help Center (US) My Account; Tax Information; Tax Information Are my winnings on DraftKings subject to state interception? (US) Additional Ways to Contact Us. Mail: US Office. 222 Berkeley St. Boston, MA 02116. Support Hours. Our team is .Navigate to the DraftKings Tax ID form. On the Confirm Your W-9 Filing page, below Name and mailing address tap/click the box next to Only issue me electronic tax forms . If all information on the screen is correct, eSign with your SSN or ITIN . However, depending on the how your winnings are classified with the payer, you may receive Form 1099-MISC. You can report winnings from a 1099-MISC as “Other Income” on your tax return. If your winnings are paid using a third-party platform like Venmo or PayPal, you may receive winnings reported on Form 1099-K. C au ti on ar y S tate me n t R e gar d i n g F or w ar d -L ook i n g S tate me n ts T hi s A nnua l R e port on F orm 10-K (t hi s “ A nnua l R e port ” ) c ont a i ns forw a rd-l ooki ng s t a t e m e nt s w i t hi n t he m e a ni ng of t he “ s a fe ha rbor” provi s i ons of

draftkings 1099 misc|DraftKings

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · What are the 1099

PH2 · Understanding Your DraftKings Tax Withholding: Key

PH3 · Tax Considerations for Fantasy Sports Fans

PH4 · Sports Betting Taxes: How to Handle DraftKings,

PH5 · Solved: Draftkings Reignmakers

PH6 · Key tax dates for DraftKings

PH7 · I received a 1099

PH8 · DraftKings Tax Form 1099

PH9 · DraftKings